The Cost of Leasing vs. Buying Solar Panels

Be sure to weigh all of the options before getting a solar system

A new solar system is an investment in your future, and requires a lot of information to make the right choices. Buying solar panels vs. Leasing solar panels is one of the biggest choices you will need to make. It may sound like a good deal to lease the solar system, but when all factors are considered, there is one clear choice.

It is hard to beat buying your solar panels. The initial investment may be larger, but the long term benefits make it the easiest decision you will make about your new solar system.

Why Leasing Solar Panels Isn’t a Good Choice

The sales pitch of the solar leasing company usually goes some like this, “There is a steep up-front cost to buy solar panels, and with leasing, you will pay little or nothing and save hundreds of dollars per year on average.” Quite an appealing sales pitch if you do zero research. The truth of the matter is as follows:

- You miss out on on federal tax benefits and any local incentives.

- Many leases contain what is known as an escalator clause that can increase your lease payment 3% per year. An example would be if you are paying 12 cents per kilowatt hour in the first year, that will increase to 18.2 cents in year 15. That means if the cost of energy doesn’t increase as quickly as the contracted lease payment increase, you savings will evaporate.

- The solar panel leasing company of course wants to maximize their profits, leaving a chance that you could end up with your roof completely full of solar panels, installed in highly visible locations, without any regard to appearance. Be sure to check the final system design and placement before you sign the lease. Changes happen between initial mock-up and final design.

- Leases can scare off future home buyers if you decide to sell your home. If you decide to sell or move before your 20 year lease agreement ends, the new homeowner will have to assume that lease with the purchase. You could also buy out the lease before the end, but you are probably trying to maximize profits if selling your home. There may be an option to relocate the system from one house to another, but there are costs involved in that also. 5 years in the future, there may well be more efficient solar options available, and you wouldn’t want to limit your options for the future.

- At the end of the lease, the solar leasing company has the option to just remove the solar system, and all your savings with it.

What You Lose By Leasing

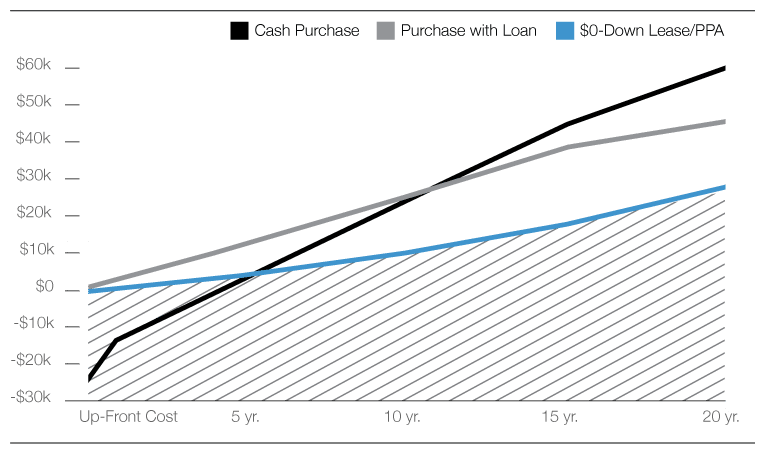

A comparison of how much a residential solar system could save a homeowner, with the type of purchase variable of Cash, Loan, and Lease.

Source: Consumer Reports

| Buying Solar | Solar Lease | |

|---|---|---|

| No Upfront Costs | No | Yes |

| Better Long-term Savings | Yes | No |

| Own the System | Yes | No |

| Qualifies for federal tax credit | Yes | No |

| Qualifies for SRECs | Yes | No |

| Easy to Sell Your Home | Yes | No |

| No Maintenance | No | Yes |

Key Takeaways

- Purchasing your solar panels with cash, is not an option for everyone. There are many financing options available including a solar loan, a home improvement loan, a signature loan, and solar leasing. These options help people who want to go solar, but don’t have cash on hand.

- Purchasing your solar panels, whether you use cash or a solar loan, gives you the best long term return on your investment.

- If you are eligible for federal tax credits and local rebates, it is best to purchase your solar panels.

- A solar lease will provide considerably less savings, and prevent you from receiving federal tax credits and local rebates.

Claim Your Free Solar Analysis Today!